The industry of housing as well as boutique home builders in Australia, particularly in New South Wales and Queensland, is booming to say the least. Real estate investors are swarming in to develop more properties in order to attract more homebuyers from different parts of the country. It is every person’s dream to own a house. Really, who doesn’t want to have a place to call home? Home ownership happens at a time when families who first became tenants paying rent on a monthly basis have already incurred enough finances and settle into getting a property where they can live for the long-term.

Indeed, purchasing a house is an important investment that needs careful planning and consideration. Getting to that point in time, however, usually requires families to undergo a complicated process of obtaining enough finances, racking up the right amount of money for down payment, and finding a suitable property or home to purchase. Of course, they would also have to deal with mortgage payments. For any first-time buyer, it may seem quite impossible to go through with the process.

It goes without saying that purchasing a house, aside from its accompanying responsibilities, involves numerous considerations. Is the home near school or work? Is the surrounding neighborhood relatively peaceful? Lifestyle and financial standing, as well as the fluctuations in the real estate market, can drive families to either success or failure in their first attempt at home buying. So to help families decide when it comes getting their first crack at purchasing a home, here are some tips they should consider:

Purchase a home to live in for the long-term. In other words, do not plunge into the home buying without first making the commitment to stay there for the long-term. It does not make any sense if a family buys a home just to sell it sooner. Indeed, any person may just delay the plan altogether and wait for the most opportune time to buy.

Have a clean credit history. Obtaining a mortgage from a lender would definitely be an obligation for most families when financing the newly-acquired home. As such, it is important for individuals to have their credit standing spotless before making mortgage payments, let alone performing a search for the most suitable house.

Go for pre-approval from a lender. Doing so can help families bypass the possibility of purchasing homes they cannot actually afford. Doing so also gives them a chance to negotiate a better offer once they’ve found their most suitable property. A pre-approval usually considers the purchasers’ credit history, debt (if any), and annual income.

Buying a home near a school is actually a good proposition. This tip applies to parents who are already sending their kids to school. However, this also applies to those who don’t send their kids anymore to school. In the event families want to sell their property, a lot of prospective buyers would come forward since most of them would like their homes near an elementary or high school.

Hire a real estate agent. This is one of the most important things first-time homebuyers should not ignore. Families know that such individuals have their best interests pursued as they are professionals who can help them out in searching for the best prices for buying a home.

Putting these tips into mind can help first-time homebuyers navigate the complex process of purchasing their first house. Seeking professional help and being making careful considerations on the financial standpoint can help them make one of the well-thought decisions in their lifetime.

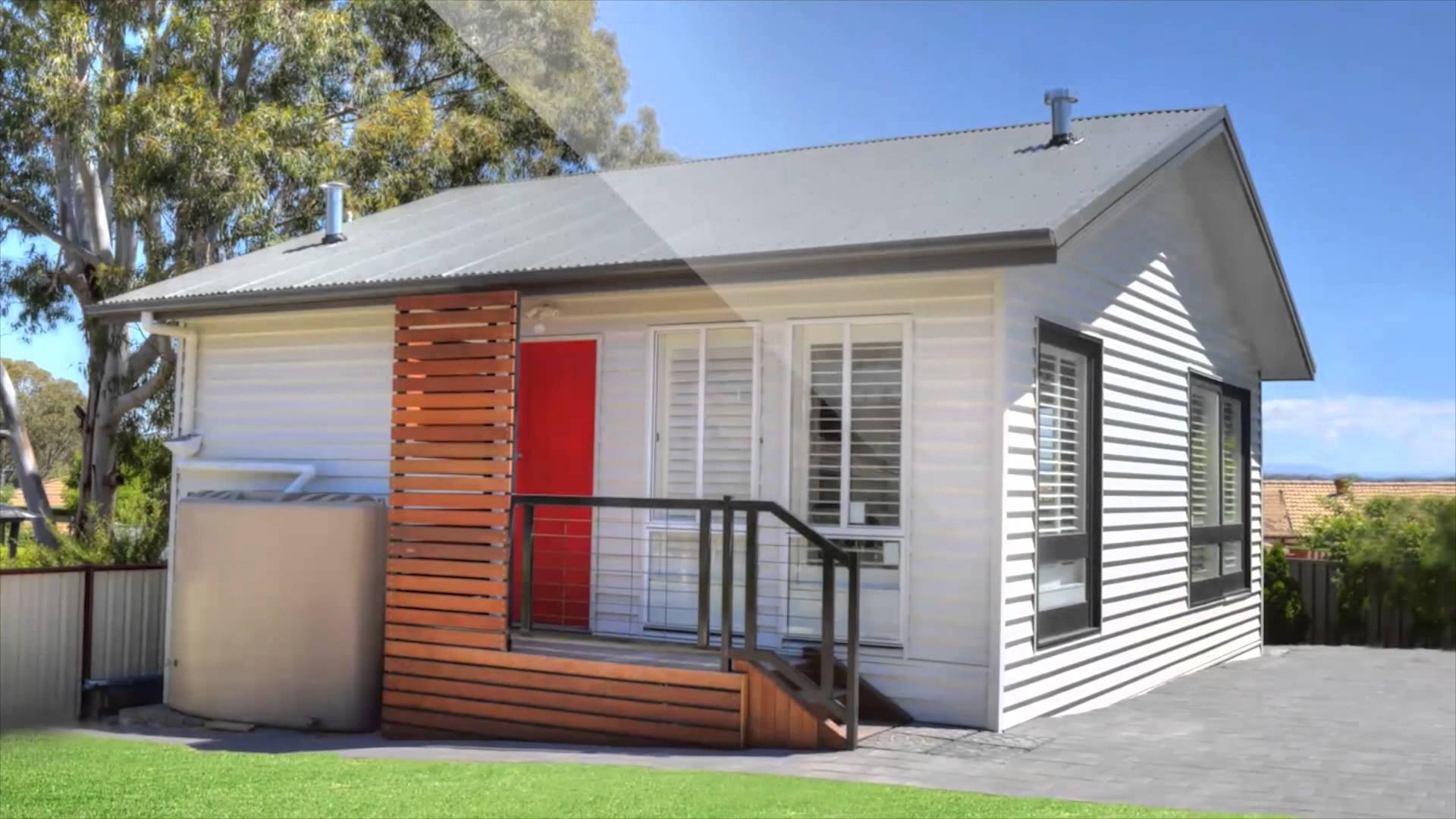

In NSW and Queensland, one particular boutique home builders company is making a good name for itself because of its extensive years in the industry (spanning to 35 years this year), excellent customer service, and drive to innovate. This company is no other than Horizon Homes, which operates in NSW and Queensland. If you are planning to purchase your first home, it is important that you go with a company that you can trust and can ensure you of the best service possible.